DHA File Market Update | Why This Is the Best Time to Invest!

DHA Lahore Market Overview – Phase 10 and Phase 13 Leading the Way

The DHA Lahore market continues to remain at the center of real estate attention. Among its numerous phases, DHA Phase 10 and DHA Phase 13 are currently the top focus areas for both end-users and investors.

DHA Phase 10

Over the past year, Phase 10 has shown a steady demand in residential and commercial files. Market rates have stabilized after previous corrections, creating a solid base for future growth. The phase’s location between Raiwind Road and Bedian Road, its proximity to Ring Road, and planned infrastructure make it an ideal long-term investment option.

This area has seen consistent inquiries from investors looking for entry-level opportunities with high future appreciation potential once development work accelerates in the coming year.

DHA Phase 13

DHA Phase 13, located along Barki Road near Ring Road interchange, continues to be one of the most affordable DHA projects with significant potential for capital growth.

The market sentiment has shifted positively as investors anticipate future balloting and possession activities, which could lead to a price surge once formal development begins.

Experts recommend Phase 13 as an excellent entry point for new investors who want to hold property in DHA at comparatively lower costs while expecting long-term returns.

DHA Quetta – Rising Interest in a Promising Frontier Market

The DHA Quetta market remains one of the most talked-about projects in Balochistan. While it is still in the early stages of large-scale development, the balloting of residential and commercial files has strengthened investor confidence.

The concept of “unsuccessful files” — those not included in the first or main ballot — has also gained traction, with buyers acquiring them at attractive rates. These files are expected to benefit once the next balloting phase is announced.

DHA Quetta’s master plan, combined with government-backed infrastructure and increasing migration from major cities, is setting the foundation for long-term value growth. Investors who enter now are expected to gain significantly once physical development reaches full momentum.

DHA Gujranwala – Emerging Hub of Affordable Investment

DHA Gujranwala continues to attract investors due to its strong infrastructure planning, affordable entry points, and active development on both residential and commercial fronts.

The commercial category, particularly 4 Marla commercial plots, has shown higher demand due to the upcoming business district and direct road connectivity with Grand Trunk (GT) Road and Sialkot-Lahore Motorway.

With its population growth and rising commercial activity, DHA Gujranwala is becoming a preferred destination for investors seeking consistent returns and rental potential.

Lahore Smart City – Development Work Resumes with Major On-Ground Progress

A major highlight of this month’s update is the resumption of full-scale development in Lahore Smart City. After a short pause, heavy machinery and workforce have returned to key zones, especially along Jinnah Avenue, the project’s 312-foot-wide main boulevard, which connects directly to Ring Road through the upcoming interchange.

Additionally, the Saudi German Hospital is under construction, and road infrastructure is being expanded to ensure better access from both GT Road and Ring Road sides.

The management has confirmed that one of the main access points is expected to open within a month, which will likely create a strong positive impact on investor confidence.

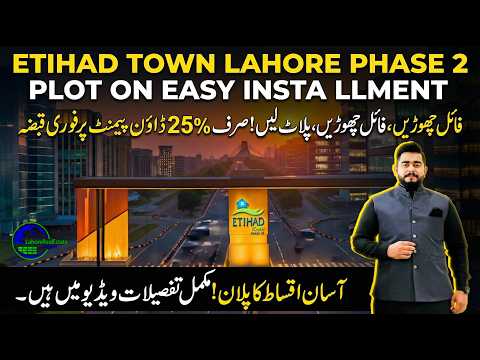

For mid-range investors, Overseas Central remains an excellent opportunity with clear plots and fully paid cost-of-land files. Meanwhile, those looking for installment-based options can explore Etihad Town Phase 3 (Phase 2 Extension) for both residential and commercial categories.

Why This Is the Right Time to Invest in Real Estate

Real estate experts agree that the current market correction represents a strategic buying opportunity. Historically, investors who enter the market during low-activity periods achieve higher capital gains when recovery begins.

According to Mian Fawad, property prices in DHA and other major societies are unlikely to drop further beyond minor short-term adjustments. With interest rate stabilization, improving construction trends, and increased infrastructure spending, the real estate market is preparing for gradual but steady recovery by early 2026.

Unlike other asset classes such as gold, which have already peaked and may see downward corrections, real estate continues to offer long-term stability, tangible ownership, and capital growth potential.

Investment Strategy – Focus on Trusted Developers and Secure Societies

In Pakistan’s property market, DHA remains the benchmark for reliability, transparency, and consistent performance. The brand’s presence across multiple cities ensures investor trust and liquidity.

Historically, whenever DHA prices move upward, other private societies follow the same trend within months.

Therefore, diversifying your portfolio across DHA Lahore, DHA Gujranwala, DHA Quetta, and Lahore Smart City can provide both short-term trading advantages and long-term capital growth.

For personalized investment guidance or portfolio evaluation, buyers can reach out to Lahore Real Estate for professional consultation and verified market options.

Conclusion

The October 2025 market outlook highlights a clear opportunity window for investors. With DHA and Lahore Smart City showing renewed activity and development, this is the time to position yourself before prices rise again.

Real estate remains Pakistan’s most resilient and profitable investment avenue, offering long-term security against inflation and economic uncertainty.

Those who act now are most likely to enjoy significant appreciation in the coming year as the market transitions from correction to recovery.

Join The Discussion

You must be logged in to post a comment.