DHA Lahore Phase 13 Files Prices. DHA 13 previously known as DHA City, is a promising real estate project in Lahore. This promising housing society stands out for its prime location, top-notch amenities, and flexible payment options for residential and commercial plots. Whether you want to move in or invest, DHA Lahore Phase 13 has something special for everyone.

DHA Lahore Phase 13 (Ex DHA City): File Prices, Location, Map, and Development Updates 2024

Initially, DHA Lahore Phase 13 was booked in 2007 under the name DHA City Lahore. It was a joint venture by DHA EME and Globaco (Pvt) Ltd. However, Globaco failed to provide land to DHA as per the agreement. The case was taken to court and NAB. After the judgment by the court, DHA took over the whole project. Now, it is purely a DHA Lahore Project and is called DHA Lahore Phase 13.

Developers of DHA Lahore Phase 13

DHA Lahore Phase 13 is developed by DHA Lahore. The development process is expected to be completed within the given time frame.

DHA Lahore Phase 13 Files Prices (Ex DHA City)

Below are the Most Latest DHA Lahore Phase 13 Files Prices Updates 2024 are as follows:

| DHA Phase13 Lahore Files Prices Update | File Price In Lacs | Call | Last Updated |

| 5 Marla | 19 | Mian Fawad +923024489001 Ch Jamshed +923224222062 Waseem Asif +923224222046 | 26 July 2024 |

| 10 Marla | 29.25 | Mian Fawad +923024489001 Ch Jamshed +923224222062 Waseem Asif +923224222046 | 26 July 2024 |

| 1 Kanal | 49 | Mian Fawad +923024489001 Ch Jamshed +923224222062 Waseem Asif +923224222046 | 26 July 2024 |

These prices are subject to change based on market demand and supply factors.

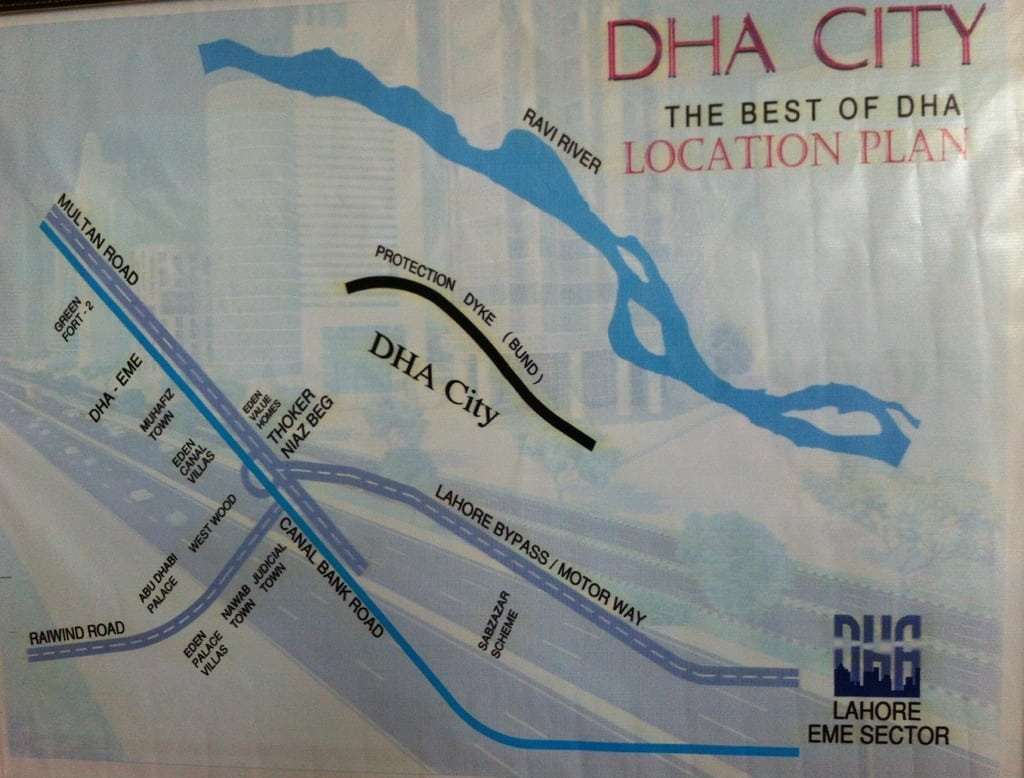

Location Map DHA Lahore Phase 13

DHA Lahore Phase 13 enjoys a prime location in Lahore. It is located next to Thokar Niaz Baig and near to Kacha Band Road. The society is conveniently accessible, making it ideal for those seeking a balance between peaceful living and access to urban conveniences.

Development Updates

DHA Lahore Phase 13 is now developed by DHA Lahore. The development work is expected to be completed within the given time frame. Possession of the plots is expected to be given to the file holders as soon as possible and according to the court’s order.

Conclusion

DHA Lahore Phase 13 is a promising residential society offering a blend of comfort, convenience, and luxury. With its strategic location, reasonable file prices, and ongoing development, it presents a great investment opportunity for those looking to invest in Lahore’s real estate.

Please note that this article is intended to provide a general overview of DHA Lahore Phase 13. For more specific information, it is recommended to visit the official website or contact the sales team.

For buying selling files or plots or assessment of your plots please call Lahore Real Estate ® with full confidence.

Ch Mujahid Yasin (CMY)

Lahore Real Estate ®

+923224929992

+9242111111040

MB-46 Main Boulevard DHA Lahore Phase 6 Near DHA Lahore Head Office.

DHA Phase 13 Lahore Videos | Prices Update | Latest Balloting News | Location Map Updates

Important Notices About DHA Lahore Phase 13

DHA Phase 13 File Prices & Market Trends: A Buyer’s Guide (Updated as of 6th June, 2024)

Considering investing in DHA Phase 13? This guide unveils the latest file prices, market trends, and valuable advice for both buyers and existing investors (as of June 05, 2024).

File Prices (Allocation Only):

- 5 Marla: PKR 20 lacs (significant drop from peak of PKR 45 lacs)

- 10 Marla: PKR 32 lacs (down from PKR 70 lacs)

- 1 Kanal: PKR 59 lacs (down from PKR 125 lacs)

- Note: Affidavit files are unavailable as DHA hasn’t acquired land yet.

Current Market Trends:

- Significant price drops across all file categories.

- Buyer activity remains low.

- Increased selling pressure from investors who bought at peak prices.

Investment Advice:

For Buyers:

- Great entry point: Current market presents a buyer’s opportunity.

For Existing Investors:

- Hold if possible: Consider holding files until market recovers.

- Avoid panic selling: Prices have reached attractive lows.

Conclusion:

DHA Phase 13 holds potential for long-term investment, especially for those seeking personal use or holding power. However, proceed with caution and consult experts like Lahore Real Estate before making any decisions.

Keywords: DHA Phase 13, File Prices, Market Trends, Investment, Lahore Real Estate

DHA Lahore Phase 13: Your Quick Guide to Real Estate Investment Updated as of14th March 2024

DHA Lahore Phase 13 is a promising real estate investment hub in 2024. This brief guide provides an overview of the latest developments, property pricing trends, and location benefits.

About DHA Lahore Phase 13: DHA Lahore Phase 13, also known as “DHA City Lahore,” is a well-planned residential project by the Defence Housing Authority (DHA). It offers modern amenities and a strategic location, making it a compelling choice for property investors.

Market Trends: In 2024, DHA Lahore Phase 13 remains a trending topic in the real estate sector. Despite recent price fluctuations, the market outlook stays optimistic due to the project’s high return potential.

Property Types: Phase 13 offers a variety of residential plots, with a focus on residential properties. The availability of files and allocation status varies depending on the specific phase and location within Phase 13.

Investment Prospects: Phase 13’s investment appeal lies in its short to medium-term profit potential, with projected returns of 70% to 100% over 2 to 3 years. However, these gains are subject to market stability and political influences.

Location Benefits: DHA Lahore Phase 13’s strategic location near Thokar Niaz Baig provides easy access to major highways, educational institutions, healthcare facilities, and commercial hubs, enhancing its appeal for investors and prospective residents.

Conclusion: Despite recent price adjustments, DHA Lahore Phase 13 continues to draw attention due to its strategic location, diverse property options, and positive market trends. Investors must conduct comprehensive research and seek expert advice before making investment decisions in Phase 13.

Contact Chaudhry Jamshed (+923224222062) for personalized assistance in buying or selling DHA Phase 13 property.

Join The Discussion

You must be logged in to post a comment.