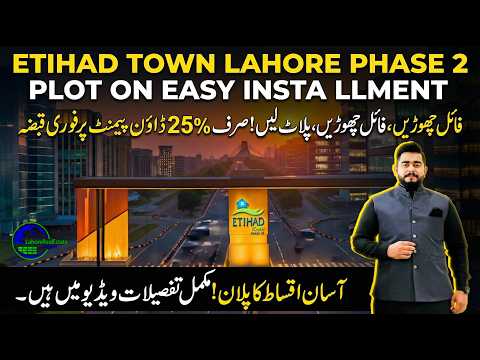

Pine Downtown Commercial Launch — The BIGGEST Investment Opportunity in Etihad Town Phase 2!

Discover the newly launched Etihad Downtown Commercial plots on Pine Avenue in Etihad Town Phase 2, Lahore. Key insights on pricing, plot sizes (8 & 5.33 marla), payment plan, possession timeline, and why this could be a top real estate investment opportunity.

Etihad Town Phase 2 is making headlines in Lahore’s real estate market, and the newly launched Pine Downtown Commercial project could present one of the most lucrative short-term and long-term investment opportunities available right now. Known as Etihad Downtown, these commercial plots on Pine Avenue are being offered with a 3-year payment plan, an early possession promise, and at prices significantly lower than earlier phases. Let’s explore what makes this deal so compelling, along with updated insights, risks, and expert analysis.

What Is Pine Downtown / Etihad Downtown?

Location & Concept

Etihad Downtown is not just another commercial strip; it occupies prime spots on the main Pine Avenue as well as key roads in Phase 3 and Phase 4 of Etihad Town. This strategic placement offers substantial frontage and exposure. According to Chaudhry Mujahid Yaseen, this area is envisioned as a “high-class community” designed for pedestrian activity, featuring parks, fountains, parking, and ample signage opportunities.

Commercial Plot Sizes

- 8 Marla Plots

- 5.33 Marla Plots: Available in park-facing and non-park-facing varieties.

Payment Plan

A

3-year installment plan is being offered for these plots, allowing for manageable payments.

Possession Timeline

An aggressive possession timeline promises that buyers will have ownership by

December 30, 2025—which is less than two months from now.

Developer Reliability

Yaseen emphasizes the project’s credibility: it’s

LDA-approved, the land is fully owned by the developer, and they have a strong track record for fast delivery.

Price Breakdown & Investment Case

| Plot Type |

Total Price |

Down-Payment |

Key Points |

| 8 Marla |

~Rs 40 million (4 crore) |

Rs 8 million (80 lakh) |

Significant discount vs earlier; prime road exposure; corner plots available. |

| 5.33 Marla (Park-Facing) |

~Rs 26 million |

Rs 5.2 million |

Overlooks a park; high visual appeal; prime location. |

| 5.33 Marla (Non Park-Facing) |

~Rs 22 million |

Rs 4.4 million |

Lower price, yet excellent visibility. |

Yaseen recommends purchasing one park-facing 5.33-marla plot and one back/buffer plot to maximize both usability and resale potential, which can offer excellent access and dual exposure.

Why This Could Be the Biggest Investment Opportunity

Undervalued Compared to Pine Avenue

These new plots are priced lower than earlier Pine Avenue commercial plots, while offering superior positioning (corner, two-sided exposure).

Fast Possession = Quick ROI Potential

The two-month promise for possession post-down-payment is aggressive. If fulfilled, it allows for early monetization through rental, signage, or resale.

Massive Foot Traffic Potential

With ample parks, a boulevard layout, and a community-centric design, Etihad Downtown aims to be a bustling destination rather than a mere stopover.

Developer Credibility

Yaseen asserts that the developer provides fast possession and has resolved legal concerns, making this a safe investment.

Long-Term Appreciation

He forecasts that these plots could appreciate similarly to his past investments in

Pine Avenue, moving from lower price points to significantly higher valuations over 8–9 years.

Risks & Challenges to Consider

- Aggressive Timelines: Any delays in possession could impact ROI.

- Market Volatility: Demand fluctuations and infrastructure issues could affect property values.

- Liquidity Risk: Selling larger commercial plots may take more time due to market conditions.

- Regulatory Risk: While the project claims LDA approval, investors should confirm all legal documentation.

Peer Feedback

Some community members express caution regarding timing and additional charges in Etihad Town projects, emphasizing the necessity for thorough due diligence.

Market Context & Strategic Insight

According to recent research, the Pine Avenue area is poised for significant growth in commercial space, making this development timely in addressing a rising demand for well-situated properties.

Is It Worth It?

Short-Term (2–3 Years):

Yes, particularly if possession is delivered as promised. The 3-year payment plan offers an attractive exit or monetization opportunity.

Long-Term (8+ Years):

The prospects look promising, especially with predicted infrastructure developments.

Risk Appetite:

Investing in this venture involves certain risks. Those who prefer a conservative approach should meticulously review all aspects before committing.

Join The Discussion

You must be logged in to post a comment.