DHA Lahore Phase 13 Files Prices (Ex DHA City) | File for Sale | Daily Prices Update 2026

| DHA Phase 13 Ex DHA City | DHA Lahore Phase 13 Ex DHA City-1 Kanal | Residential Allocation File@58.25 | Ch Mujahid Yasin +923224929992 & Adil Saeed +923224009766 Updated: 2/18/2026 |

| DHA Phase 13 Ex DHA City | DHA Lahore Phase 13 Ex DHA City-10 Marla | Residential Allocation File@29 | Ch Mujahid Yasin +923224929992 & Adil Saeed +923224009766 Updated: 2/18/2026 |

| DHA Phase 13 Ex DHA City | DHA Lahore Phase 13 Ex DHA City-5 Marla | Residential Allocation File@17.75 | Ch Mujahid Yasin +923224929992 & Adil Saeed +923224009766 Updated: 2/18/2026 |

These prices are subject to change based on market demand and supply factors.

DHA Lahore Phase 13 Files Prices. DHA 13 previously known as DHA City, is a promising real estate project in Lahore. This promising housing society stands out for its prime location, top-notch amenities, and flexible payment options for residential and commercial plots. Whether you want to move in or invest, DHA Lahore Phase 13 has something special for everyone.

DHA Lahore Phase 13 (Ex DHA City): File Prices, Location, Map, and Development Updates 2026

Initially, DHA Lahore Phase 13 was booked in 2007 under the name DHA City Lahore. It was a joint venture by DHA EME and Globaco (Pvt) Ltd. However, Globaco failed to provide land to DHA as per the agreement. The case was taken to court and NAB. After the judgment by the court, DHA took over the whole project. Now, it is purely a DHA Lahore Project and is called DHA Lahore Phase 13.

Developers of DHA Lahore Phase 13

DHA Lahore Phase 13 is developed by DHA Lahore. The development process is expected to be completed within the given time frame.

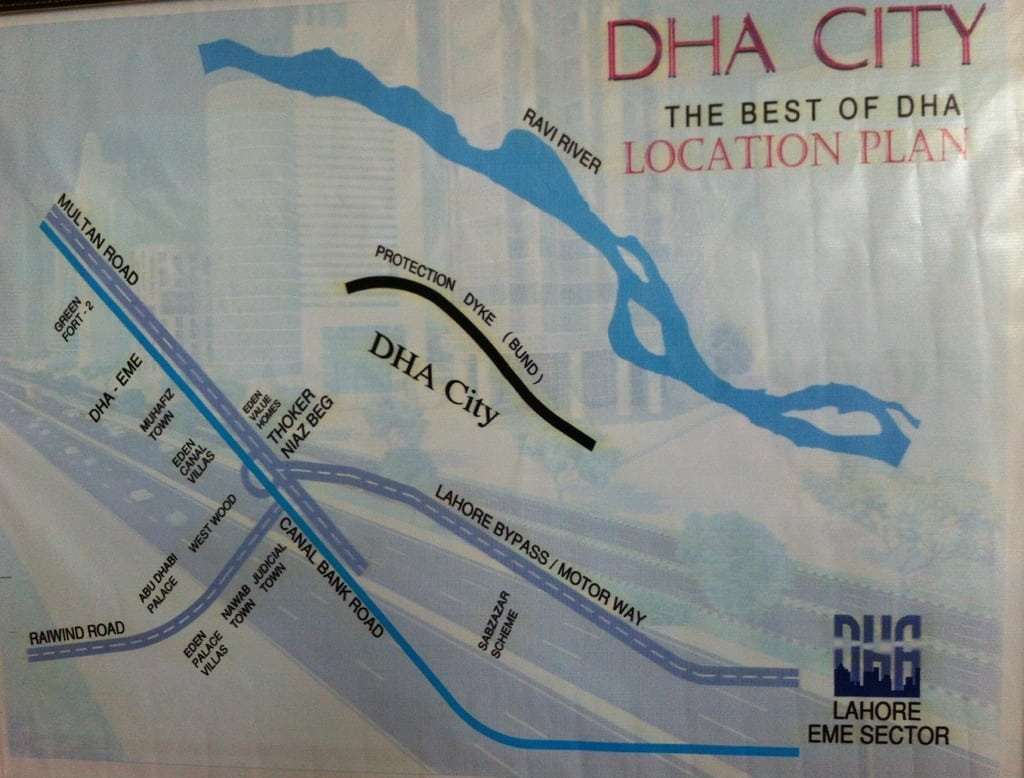

Location Map DHA Lahore Phase 13

DHA Lahore Phase 13 enjoys a prime location in Lahore. It is located next to Thokar Niaz Baig and near to Kacha Band Road. The society is conveniently accessible, making it ideal for those seeking a balance between peaceful living and access to urban conveniences.

Development Updates

DHA Lahore Phase 13 is now developed by DHA Lahore. The development work is expected to be completed within the given time frame. Possession of the plots is expected to be given to the file holders as soon as possible and according to the court’s order.

Conclusion

DHA Lahore Phase 13 is a promising residential society offering a blend of comfort, convenience, and luxury. With its strategic location, reasonable file prices, and ongoing development, it presents a great investment opportunity for those looking to invest in Lahore’s real estate.

Please note that this article is intended to provide a general overview of DHA Lahore Phase 13. For more specific information, it is recommended to visit the official website or contact the sales team.

DHA Lahore Phase 13 Transfer Fee Schedule – March 2026 Update

If you’re planning to buy or sell property in DHA Lahore Phase 13, it’s important to understand the latest transfer fee schedule. Below is a detailed breakdown of the transfer expenses for both buyers and sellers, updated for 2026.

Transfer Fee Schedule for Buyers & Sellers

The following are the costs associated with buying property in DHA Lahore Phase 13:

For buying selling files or plots or assessment of your plots please call Lahore Real Estate ® with full confidence.

Ch Mujahid Yasin (CMY)

Lahore Real Estate ®

+923224929992

+9242111111040

MB-46 Main Boulevard DHA Lahore Phase 6 Near DHA Lahore Head Office.

DHA Phase 13 Lahore Videos | Prices Update | Latest Balloting News | Location Map Updates

Important Notices About DHA Lahore Phase 13

DHA Lahore Phase 13 Investment Guide | Buy or Sell Now? Market Update 1st May 2025

Assalamu Alaikum viewers, this is Waseem Ashiq from Lahore Real Estate. Whether you’re interested in buying or selling DHA Lahore Phase 13 files, this article will help guide your investment decision based on the current market dynamics of May 2025.

Latest File Prices in DHA Phase 13 (As of May 2025)

| File Type | Price (PKR) |

|---|---|

| 5 Marla | 2,485,000 |

| 10 Marla | 4,500,000 |

| 1 Kanal | 6,300,000 |

These prices have seen noticeable fluctuations in recent weeks, especially due to the current downward trend across the real estate market in Pakistan.

Current Market Trend: Downward but Opportunistic

-

Downtrend Observed: The market is experiencing a general decline, not just in DHA Phase 13, but in other sectors as well. This is primarily due to economic uncertainty and local political conditions.

-

Price Corrections:

-

1 Kanal file previously stood at around PKR 6.7 million, now available for PKR 6.3 million.

-

10 Marla files dipped from around PKR 4.1 million to PKR 4.5 million.

-

5 Marla files are volatile and widely available due to their lower budget requirement.

-

-

Investor Sentiment: Sellers who purchased files at lower rates (e.g., 5 Marla at 1.7–1.8 million) are now looking to cash out, fearing further price drops.

Buyer & Seller Strategy (2025)

For Buyers:

-

Good Time to Enter: If you’ve been waiting for prices to drop below PKR 6.3M for Kanal or around PKR 2.5M for 5 Marla, this could be your entry point.

-

Budget Segments:

-

If your budget is around PKR 2.5 million: 5 Marla is ideal.

-

If you have PKR 4.5 million: consider 10 Marla.

-

For long-term stability and returns: 1 Kanal remains the preferred choice.

-

For Sellers:

-

Consider Selling at Lock-in Profit: If you’re still in profit, this could be a good time to sell. The market has shown a pattern where prices touch a peak (e.g., 5 Marla at 2.5M), then quickly decline again.

-

Avoid Holding Too Long: Waiting for a further increase might be risky given the current market sentiment.

Transfer Costs (Updated for 2025)

| File Type | Transfer Charges (PKR) |

|---|---|

| 5 Marla | Call us |

| 10 Marla | 215,000 |

| 1 Kanal | 384,000 |

Expert Insights & Predictions

-

Real Estate Market Needs Government Support: No strong positive signals from the government have been observed recently, which keeps investor confidence low.

-

Buy Low, Sell High Strategy: Files purchased at lower rates in early 2025 have already generated substantial profits for investors who sold timely.

-

Watch December 2025: It is predicted that positive announcements for Phase 13 may come near the end of the year—potentially boosting the market.

Recommendation for End Users

If you are buying for personal use (end-use), it’s wise to wait a few months, as the market might dip further. However, keep monitoring closely because unexpected announcements or shifts could change dynamics quickly.

Conclusion

DHA Lahore Phase 13 continues to be a promising investment opportunity, especially at its current low prices. If your investment strategy is based on long-term growth, this may be the best time to enter before prices bounce back.

DHA Lahore Phase 13: Major Development Update & Exclusive Soil Testing Insights (Updated 29th March 2025)

DHA Lahore Phase 13 continues to generate buzz in the real estate market, attracting investors and buyers keen on capitalizing on its growth potential. The latest developments surrounding soil testing and property transactions suggest a promising future. In this detailed analysis, we will explore the most recent updates, market trends, and the impact of economic factors on DHA Lahore Phase 13.

Latest Developments in DHA Lahore Phase 13

Recent soil testing activities have sparked curiosity among investors and real estate enthusiasts. A viral image showcasing soil testing in the area has led to speculation regarding the exact location. While precise details remain undisclosed due to professional constraints, experts confirm that the developments are progressing positively.

With Ramadan coming to an end, the property market is expected to gain momentum after Eid. Historically, trading activities slow down during Ramadan, with overseas Pakistani investors observing a wait-and-watch approach. However, once market conditions stabilize, transaction volumes are likely to surge.

Real Estate Market Trends and Analysis | Daily Transactions in DHA Lahore

Despite economic fluctuations, DHA Lahore maintains an active real estate market. On an average day, approximately 30 to 35 transactions take place, primarily in:

- DHA Phase 10

- DHA Phase 13

- DHA Phase 7

- DHA Phase 8

- DHA Phase 9 Prism

A total of 60 transactions (30 buyers and 30 sellers) occur daily, reinforcing investor confidence and the market’s resilience. The notion that the market is at risk of crashing is unfounded, as data suggests consistent trading activity.

Impact of Tax Policies on DHA Lahore

The real estate market has been affected by fluctuating tax policies. Initial reports suggested potential tax relaxations, but the Federal Board of Revenue (FBR) later denied any such announcements. This inconsistency has kept investors cautious, yet the long-term outlook for DHA Lahore remains optimistic.

Investment Insights: Buy Now or Wait?

For investors contemplating whether to buy now or wait for further price corrections, the market dynamics suggest an upward trajectory.

- Current Market Prices & Predictions:

- A 5-marla property that was once valued at PKR 18 lakh surged to PKR 45 lakh before stabilizing.

- The latest correction brought it down to PKR 27 lakh, reflecting minor fluctuations rather than a market crash.

- 10-marla properties, which were priced at PKR 47-48 lakh, are now settling at PKR 43-50 lakh.

- 1-kanal plots saw an initial surge to PKR 90 lakh but have now adjusted to PKR 76-77 lakh.

Given these trends, waiting too long could mean paying higher prices in the near future.

Exclusive Insights: Soil Testing & Location Speculations

The ongoing soil testing is a crucial step in DHA Lahore Phase 13’s development. While the exact location remains undisclosed due to legal and ethical considerations, it is confirmed that testing is being carried out in multiple zones across an area spanning 1000-1500 acres.

What This Means for Investors

- Positive Developments: Continuous soil testing indicates that DHA Lahore Phase 13 is on track for infrastructural progress.

- Market Growth: With each phase of development, property values are expected to appreciate steadily.

- Transparency & Updates: Reliable sources will continue providing verified information to investors while maintaining industry confidentiality.

Conclusion

DHA Lahore Phase 13 is witnessing significant advancements, making it an attractive investment destination. While market fluctuations are inevitable, long-term prospects remain strong. Investors are encouraged to stay informed, act strategically, and leverage the opportunities emerging in this thriving real estate hub.

Stay tuned for more updates on DHA Lahore Phase 13 as we bring you the latest insights on property trends, development milestones, and expert investment strategies.

Geotechnical Investigation for DHA Phase 13 Lahore by NESPAK (Updated 26th March 2025)

DHA Phase 13 Lahore is emerging as a prime residential and commercial development, attracting investors and homebuyers alike. Before any large-scale development, a geotechnical investigation is crucial to assess the soil properties and ensure the stability of future structures. NESPAK (National Engineering Services Pakistan), a renowned engineering consultancy firm, has undertaken the on-site soil investigation for DHA Phase 13 Lahore.

What is a Geotechnical Investigation?

A geotechnical investigation is a detailed study of soil conditions at a construction site. It helps engineers understand the strength, composition, and bearing capacity of the soil, ensuring safe and durable infrastructure development.

Objectives of Geotechnical Investigation in DHA Phase 13

The primary objectives of NESPAK’s soil testing in DHA Phase 13 Lahore include:

✅ Soil Bearing Capacity Analysis – Determines how much load the soil can support

✅ Subsurface Soil Composition Study – Identifies different soil layers and their properties

✅ Groundwater Level Assessment – Helps in designing foundations and drainage systems

✅ Compaction & Settlement Studies – Ensures stability for high-rise and low-rise structures

✅ Seismic Risk Evaluation – Identifies potential earthquake-related risks

Methods Used by NESPAK for Soil Investigation

NESPAK employs advanced geotechnical testing techniques to assess soil conditions. The investigation includes:

🔹 Standard Penetration Test (SPT) – Measures soil resistance and strength

🔹 Soil Boring & Sampling – Extracts soil samples for laboratory testing

🔹 Cone Penetration Testing (CPT) – Determines soil consistency and compaction

🔹 Groundwater Monitoring – Checks water table levels affecting construction

🔹 Laboratory Soil Analysis – Evaluates moisture content, density, and classification

Significance of Geotechnical Investigation in DHA Phase 13

The results of NESPAK’s geotechnical investigation will play a crucial role in urban planning, foundation design, and infrastructure development in DHA Phase 13. Proper soil testing ensures:

✅ Safe & Stable Foundations – Reducing risks of settlement or structural failure

✅ Efficient Drainage Systems – Preventing waterlogging and erosion

✅ Optimized Construction Costs – Avoiding unnecessary reinforcements

✅ Long-Term Sustainability – Ensuring buildings withstand environmental conditions

Conclusion

The geotechnical investigation by NESPAK for DHA Phase 13 Lahore is a critical step toward ensuring a strong and sustainable development. With detailed soil analysis and expert recommendations, DHA Phase 13 is set to become a well-planned and structurally sound housing society, promising high investment potential and a secure living environment.

Join The Discussion

You must be logged in to post a comment.