DHA LAHORE PHASE 10 PLOT FILES FOR SALE BY LAHORE REAL ESTATE

| DHA Lahore Phase 10-1 Kanal | Residential Allocation File@77.5 | Ch Mujahid Yasin +923224929992 & Adil Saeed +923224009766 Updated: 2/18/2026 |

| DHA Lahore Phase 10-1 Kanal | Residential Affidavit File@87 | Ch Mujahid Yasin +923224929992 & Adil Saeed +923224009766 Updated: 2/18/2026 |

| DHA Lahore Phase 10-10 Marla | Residential Allocation File@44.5 | Ch Mujahid Yasin +923224929992 & Adil Saeed +923224009766 Updated: 2/18/2026 |

| DHA Lahore Phase 10-10 Marla | Residential Affidavit File@46 | Ch Mujahid Yasin +923224929992 & Adil Saeed +923224009766 Updated: 2/18/2026 |

| DHA Lahore Phase 10-2 Kanal | Residential Allocation File@On Call Call | Ch Mujahid Yasin +923224929992 & Adil Saeed +923224009766 Updated: 2/18/2026 |

| DHA Lahore Phase 10-2 Kanal | Residential Affidavit File@234 | Ch Mujahid Yasin +923224929992 & Adil Saeed +923224009766 Updated: 2/18/2026 |

| DHA Lahore Phase 10-4 Marla | Commercial Allocation File@127 | Ch Mujahid Yasin +923224929992 & Adil Saeed +923224009766 Updated: 2/18/2026 |

| DHA Lahore Phase 10-4 Marla | Commercial Affidavit File@131.5 | Ch Mujahid Yasin +923224929992 & Adil Saeed +923224009766 Updated: 2/18/2026 |

| DHA Lahore Phase 10-5 Marla | Residential Allocation File@25.25 | Ch Mujahid Yasin +923224929992 & Adil Saeed +923224009766 Updated: 2/18/2026 |

| DHA Lahore Phase 10-5 Marla | Residential Affidavit File@27.25 | Ch Mujahid Yasin +923224929992 & Adil Saeed +923224009766 Updated: 2/18/2026 |

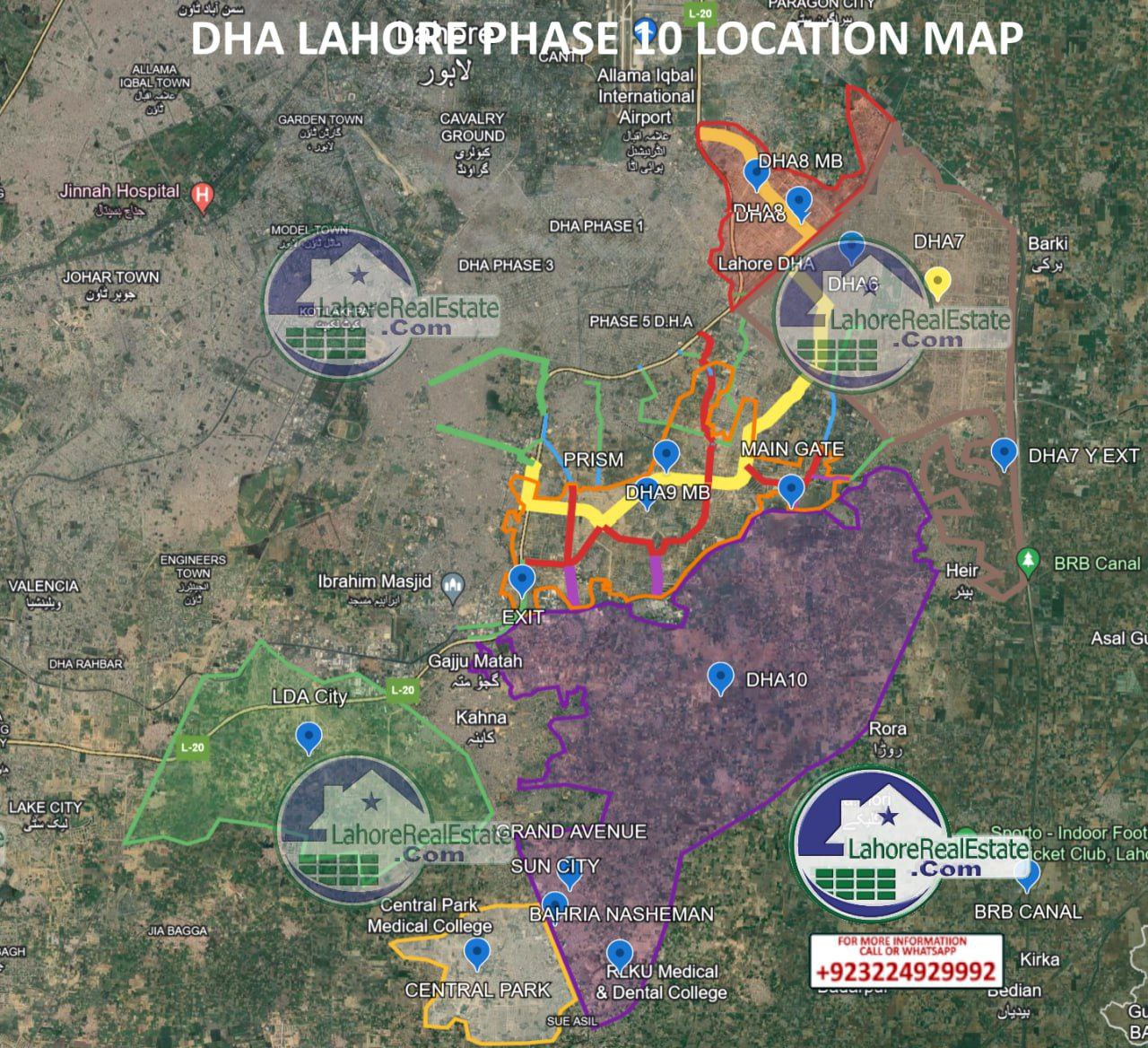

DHA Lahore Phase 10 Location

DHA Lahore Phase 10, nestled between Bedian and Ferozepur Roads, boasts a prime location adjacent to DHA Phase 9 Prism having access Lahore Ring Road Feroz Pur Interchange . It will be a Most modern Phase of DHA Lahore.

- Modern infrastructure and amenities: it will be 1st of dha lahore having main boulevards of 300 feet . Other amenities Parks, playgrounds, mosques, Golf courses, community centers, educational institutions, healthcare facilities, and commercial areas are planned.

- Gated Community : Unlike other phases of dha Lahore, It will 1st of dha lahore with full proof Security and dedicated Exist and entry like Askari 11.

- High quality of life: A secure environment and a well-designed community promise a comfortable living experience.

Ready to Invest In DHA Lahore Phase 10 Files?

If you’re looking for a safe and promising investment in DHA Lahore, Phase 10 files could be the ideal choice. To discuss your options and make informed decisions Contact us At +923224929992.

Exciting Developments and Investment Opportunities:

DHA Phase 10 presents a compelling prospect for investors seeking a secure and potentially lucrative real estate opportunity., this highly anticipated project is poised for significant development shortly.

DHA Lahore Phase 10 Files Balloting – Complete Guide

DHA Estate Agents Association (DHA EAA) has announced a major milestone for property buyers and investors with the release of official balloting details for DHA Lahore Phase 10 files. This development is being seen as a historic achievement for the association and a strong signal of confidence in the Lahore real estate market. With clearly defined categories, prices, payment plans, and eligibility criteria, Phase 10 files offer a structured and transparent opportunity for both realtors and the general public to participate in one of Lahore’s most anticipated DHA phases.

Categories Offered in Phase 10

DHA Lahore Phase 10 files are being launched with a mix of residential and commercial plot categories designed to cater to a wide range of buyers and investment profiles. On the residential side, the sizes include 5 marla, 8 marla, 10 marla, and 20 marla, which cover everything from compact investment plots to larger options suitable for future house construction. For commercial buyers and business‑minded investors, 4 marla and 8 marla commercial plots are being offered, giving opportunities for future retail, offices, and rental income in a planned commercial hub.

Official Prices of Residential and Commercial Files

The price structure shared for Phase 10 files provides a clear entry point for investors evaluating affordability and potential returns. Residential files are priced as follows: 5 marla at 45 lakhs, 8 marla at 65 lakhs, 10 marla at 75 lakhs, and 20 marla at 150 lakhs, positioning the project competitively within the DHA Lahore spectrum. Commercial files are offered at 210 lakhs for 4 marla and 420 lakhs for 8 marla, reflecting the premium nature and income potential of commercial real estate in an upcoming DHA phase.

Flexible 4‑Year Payment Plan

One of the most attractive features of the Phase 10 launch is the structured 4‑year payment plan, which helps spread the financial burden over time and makes participation easier for a broader segment of buyers. The expected down payment ranges from 10 percent to 15 percent, with indications that it will likely be around 10 percent, making initial entry more accessible compared to lump‑sum purchase models. After the down payment, buyers can manage the remaining amount through scheduled installments over four years, aligning with salary earners, overseas Pakistanis, and long‑term investors who prefer gradual payments.

Two Separate Balloting Segments

To ensure fair access and structured allocation, DHA Lahore Phase 10 files balloting has been divided into two main segments. The first segment is dedicated to registered realtors, specifically association‑registered CEOs, acknowledging the role of professional estate agents in promoting and supporting DHA projects. The second segment is reserved for the general public, where all Pakistani CNIC holders are eligible to participate, creating a wide opportunity for local and overseas Pakistanis to secure files through a transparent balloting process.

Ballot Date and Official Announcement

The exact ballot date for Phase 10 files has not yet been specified in the shared details; however, DHA Lahore will announce the official balloting date in the coming days. Prospective buyers and investors are advised to stay alert to official updates so they can complete formalities, documentation, and payments in time to be included in the ballot. This upcoming announcement is expected to generate strong activity in the market, as balloting in a new DHA phase often becomes a key trigger for demand and price movement.

Special Quota for Registered Realtors

A significant highlight of this launch is the allocation of a separate quota of files for association‑registered realtors, which DHA EAA has termed a historic achievement for the organization. This reserved quota is a recognition of the services and support provided by registered agents and ensures that genuine professional stakeholders have dedicated access within the overall inventory. The association has expressed gratitude to DHA management for granting this facility, which further strengthens the relationship between DHA authorities and the regulated real estate community.

Why Phase 10 DHA Lahore Is a Big Opportunity

For investors and homebuyers, Phase 10 DHA Lahore combines several attractive factors: reputable developer backing, structured payment terms, defined categories, and a transparent balloting system. The pricing for both residential and commercial files is positioned to appeal to medium and long‑term investors who are looking for capital growth as development progresses. With the formal release of balloting details and payment structures, Phase 10 stands out as a strategic option for those seeking entry into Lahore’s premium planned communities with future infrastructure, security, and lifestyle facilities.

Development Roadmap of DHA Lahore Phase 10

Expect development of DHA Phase 10 is meticulously planned, commencing within the next year and unfolding in a phased manner. DHA is willing to develop it 1st phase contrary to past

Ballot and Plot Availability:

While the exact date for the DHA Lahore ballot remains within a 1-2 year timeframe, potential investors can anticipate a wait of approximately 5 years or more for developed plots to become available. This extended timeframe emphasizes the long-term investment nature of DHA Phase 10.

Understanding File Types and Tax Implications:

DHA Lahore offers both affidavits and allocation files, essentially representing the same ownership right. The initial transfer of a file involves an affidavit transfer, followed by allocation within 15 days. Subsequent transfers utilize allocation files.

Investment Opportunity in DHA Lahore Phase 10:

Investors seeking to minimize tax burdens often favor affidavit files. Although these files come with a higher initial cost, they offer significant advantages such as reduced transfer fees and exemption from stamp duty, capital gains tax, and withholding tax. Allocation files, on the other hand, present a lower initial cost but incur higher transfer fees.

Security and Convenience:

Both affidavit and allocation files are officially transferred by DHA Lahore, ensuring a secure and transparent process. This eliminates the need for investors to travel to Pakistan for the transaction, offering added convenience for international investors.

Available Plot Sizes and Costs:

DHA Phase 10 offers a variety of residential and commercial plot sizes to cater to diverse investor needs. It’s crucial to note that costs are estimates and may fluctuate based on market conditions. Consulting with a qualified real estate professional is highly recommended for obtaining the most up-to-date information and guidance.

- Residential Files ( 5-Marla, 8-Marla,10-Marla, 1-Kanal, 2-Kanal

- Commercial Files ( 4-Marla)

DHA Lahore Phase 10 Transfer Expenses Affidavit & Allocation File | 2025-26

The transfer fees associated with buying a Affidavit files in DHA Lahore Phase 10. Here’s a breakdown of the costs:

DHA Phase-10 Files Prices Chart

Most Latest Development and Prices Update videos of DHA Phase 10 Files

IMPORTANT NOTICE FOR DHA PHASE 10 Lahore

DHA Lahore Phase 10 Price Surge: Is DHA Quetta the Next Investment Goldmine? (Updated December 6, 2025)

The DHA files market in Pakistan is witnessing a dramatic turnaround as of early December 2025, with DHA Lahore Phase 10 leading a sharp price rally that has spilled over to Phase 13 and reignited interest in DHA Quetta. Investors who missed the initial Phase 10 boom now eye these developments for high-return opportunities, driven by limited supply, surging buyer demand, and a shift from prolonged downtrends to upward momentum.

Current File Prices in DHA Lahore Phase 10

DHA Lahore Phase 10 files have surged significantly over the past few days, with 5 marla affidavit files now at approximately PKR 3.51 million and no lower availability, 10 marla at PKR 9.15 million, 1 kanal around PKR 15 million, and 4 marla commercial files reaching PKR 15.3 million on a first-come, first-served basis due to tight supply. This sudden jump reflects strong market recovery signals, as Phase 10 files—backed by actual land allocation—typically lead real estate upswings before plots follow suit.

DHA Lahore Phase 13: Following the Phase 10 Rally

As Phase 10 prices climbed, DHA Lahore Phase 13 quickly followed, with 5 marla buyer rates around PKR 2.5 million, 10 marla at PKR 3.5 million, and 1 kanal buyers near PKR 5.4 million, but sellers have vanished amid allocation-only files and high demand from Phase 10 overflow investors. Limited supply in Phase 13 creates a seller’s market, positioning it as a solid mid-budget option with strong appreciation potential in the coming development phases.

DHA Quetta Emerges as Low-Budget Powerhouse

DHA Quetta files are gaining traction as the best alternative for budgets of PKR 2.5-3 million, offering 5 marla at PKR 1.175 million, 10 marla at PKR 1.5 million, 1 kanal barcode at PKR 2.5 million, second-balance allocation near PKR 2.5 million, and unsuccessful files between PKR 1.5-2.5 million—delivering far more land value like 1 kanal for the price of Phase 10’s 5 marla. Historical gains of up to 300% in Quetta versus 70-80% in Phase 10 underscore its higher upside, especially as the market bottom has passed and recovery accelerates.

Why Invest Now? Market Trends & Budget Comparison

The real estate sentiment has flipped from daily drops to optimism, with DHA files spearheading recovery due to genuine land backing unlike private schemes. For PKR 3 million, Phase 10 yields just 5 marla, while Quetta provides a full 1 kanal file—ideal for long-term growth in a stabilizing 2025 market. Experts recommend sticking to proven DHA projects over untested ones for reliable returns.

DHA Lahore Phase 10 Installment Files Launch: Cash Prices Surge Ahead of Official Announcement

Published: December 5, 2025

Discover the latest buzz in Lahore real estate as DHA Phase 10 residential and commercial files gear up for a groundbreaking launch with flexible 4-year installment plans. Cash file prices are skyrocketing due to anticipation—perfect timing for savvy investors eyeing high returns in Pakistan’s property market.

DHA Lahore Phase 10 is making waves with upcoming installment-based files for both residential and commercial plots, offering a rare opportunity after years without such options. Reliable sources point to attractive pricing: 5 marla residential files starting at 45-50 lakh, 8 marla between 55-70 lakh, 10 marla from 75-80 lakh, 1 kanal around 1.5 crore, 4 marla commercial at 1-1.25 crore, and 8 marla commercial ranging 4.25-4.5 crore. These rates appear premium today but deliver exceptional value by 2026 delivery, with minimal down payments (10-20%) and quarterly installments making entry accessible.

The news has ignited a rapid cash file price surge across sizes, fueled by DHA billboards on key routes like Ghazi Road and Ring Road entrances. Examples include 5 marla jumping from 24 lakh to 95 lakh, 8 marla from 30 lakh to 40 lakh, 10 marla from 40 lakh to 50 lakh, 1 kanal from 80 lakh to 90 lakh, 4 marla commercial from 1.3 crore to 1.5 crore, and 2 kanal from 3.3 crore to 3.45 crore—all within a week of heightened buyer interest. Smaller plots (5, 8, 10 marla residential and 4 marla commercial) lead demand due to low FBR valuations, minimal taxes on intimation letter transfers (1.5% selling, 4.5% allocation), and easy trading even mid-installment.

Why Invest in DHA Phase 10 Now?

-

Market Momentum: Strong demand-supply balance favors sellers; files are hard to find when buying but quick to sell in positive markets.

-

Investment Perks: Low entry barriers, no heavy FBR taxes, and positioning for 2026 appreciation in Lahore’s prime development.

-

Buyer Strategy: Secure cash files immediately before official launch pushes prices higher—ideal for long-term gains.

This setup positions DHA Lahore Phase 10 as a top pick for Lahore real estate investments, blending affordability, liquidity, and growth potential. Stay tuned for official details on Lahore Real Estate platforms.

DHA Lahore Phase 10 Rates Update (December 03, 2025): Affidavit Files Surge in Demand

DHA Lahore Phase 10 real estate market shows steady positive momentum with robust buying in affidavit files, marking it as a top investment spot in Lahore’s prime property sector as of December 03, 2025. Around 150 affidavit files traded in the last 10 days drive gradual rate hikes in a stable, healthy recovery after a short pause. Buyers now see bottom prices passed, fueling confidence for long-term gains in this expanding DHA phase.

Current File Rates in DHA Lahore Phase 10 (December 03, 2025)

Prevailing rates reflect upward trends across categories, with affidavit files leading demand.

-

5 Marla Affidavit: PKR 2.25 million (up from PKR 2.26 million last week)

-

10 Marla Affidavit: PKR 4.5 million (from PKR 4.35 million)

-

1 Kanal Affidavit: PKR 8.25 million (range confirmed)

-

2 Kanal Files: PKR 13.8 million

-

Commercial Plots: PKR 13.7 million (allocations unavailable)

Allocation rates hold at PKR 2.5-2.6 million for 5 Marla, PKR 4.3 million (plus-minus) for 10 Marla, and PKR 7.7 million for 1 Kanal, with scarce supply in smaller sizes. These align with broader DHA trends showing Phase 10 recovery amid Lahore file market activity.

Why Affidavit Files Demand is Booming in Phase 10

High trading volume signals genuine growth, with slow yet steady increases, avoiding volatility. Investors enter now as rates bottomed out, expecting further appreciation in DHA Lahore’s development pipeline. Compared to Phases 9 or 13, Phase 10 offers affordable entry with strong liquidity from recent sales.

DHA Lahore Phase 10 Market (Update December 2025)– Prices Showing Strong Recovery

The real estate market of DHA Lahore Phase 10 is witnessing a notable recovery as fresh buyer interest returns and file prices start climbing up again after a period of correction. In the latest weekly update dated November 29, 2025, the market recorded active trading, especially in affidavit files, while allocation files remain scarce due to limited seller availability. This trend signifies renewed confidence and a bullish phase for investors looking to enter or expand their holdings in one of Lahore’s most promising real estate sectors.

Currently, 5 marla affidavit files are trading near 27 lakh PKR, making them a sought-after option, while allocation files for the same size plot are nearly impossible to find due to fewer sellers at 25 lakh. The 10 marla affidavit files are available around 44.5 lakh, with allocation files hovering near 44.2 lakh, again highlighting the shortage of genuine sellers. The demand-supply gap is visible prominently across plot sizes, including 1 kanal and 2 kanal categories, where affidavit files are being finalized at 85 lakh and 1.36 crore PKR respectively, but allocation files remain very limited.

Commercial property files, notably 4 marla commercial plots, are similarly impacted by scarcity, trading near 1.37 crore PKR, with allocation prices steady around 1.3 crore. When compared to last week, these rates indicate an upward momentum, dismissing previous market bottom speculation. This renewed activity suggests investors should consider entering the market now rather than waiting for further price dips.

For short, medium, and long-term investors, DHA Phase 10 remains the primary driver of DHA file value trends, setting the tone for other phases to follow. With allocation files hard to find and affidavit files attracting strong buyer interest, this phase offers compelling opportunities for profitable real estate investments in Lahore.

DHA Lahore Phase 10 Investment Guide for Smart Buyers (2025 Update)

DHA Lahore Phase 10 is one of the most talked‑about property markets in Lahore. While it offers excellent long-term potential, it is also surrounded by hype and misleading expectations. This guide breaks down real market insights, risks, file rates, and strategies for smart investors.

Why DHA Phase 10 Is Attracting Investors

Prime Location Advantages

DHA Phase 10 is strategically located between:

- Bedian Road

- Ferozepur Road

- Close to DHA Phase 9 Prism

Future Growth Expectations

The phase is expected to grow rapidly once:

- Balloting takes place

- Development officially begins

- Master planning is finalized

Current Market Nature

Right now, Phase 10 is a file-based market, meaning all buying and selling involves future plots rather than developed land.

Current File Rates in 2025

5 Marla File Price

PKR 2.7M – 2.8M

10 Marla File Price

PKR 4.3M – 4.8M

1 Kanal File Price

PKR 7.8M – 8.5M

These prices make Phase 10 one of the most affordable options within DHA Lahore.

Is DHA Phase 10 a Long-Term or Short-Term Investment?

Investment Timeline

DHA Phase 10 is strictly a long-term investment, requiring:

- Minimum 5 years

- Ideally 10 years for strong ROI

What Will Drive Price Growth?

Key Factors Include:

- DHA balloting

- Infrastructure development

- Town planning progress

- Market stability

- Investor confidence

Beware of Artificial Market Hype

Common Hype Tactics

Dealers often artificially push prices through:

- Fake demand

- Rumors of balloting

- Short-term speculative moves

How to Avoid Hype Risks

Smart Buyer Actions:

- Verify real demand

- Check file authenticity

- Avoid price jumps created by hype

- Study long-term DHA development history

- Buy during quiet market phases

Why DHA Phase 10 Is Still a Strong Long-Term Investment

Key Advantages

- DHA’s reputation ensures credibility

- Strong historic ROI in DHA phases

- Strategic location connecting growth corridors

- Low entry cost compared to developed phases

Expected Future Price Growth

Balloting Impact

Once balloting is announced:

- Prices can increase sharply

- Market activity will rise

- File-to-plot conversion boosts investor confidence

This trend was seen previously in Phase 9 Prism and other DHA phases.

Expert Tips for Smart Investing in Phase 10

1. Buy From Trusted Sources Only

Avoid unknown brokers and verify documents thoroughly.

2. Plan for Long-Term Holding

At least 5–10 years ensures strong returns.

3. Understand File Types

Affidavit File vs Allocation File

- Affidavit Files: Dealer-based, flexible

- Allocation Files: DHA-issued, more secure

4. Monitor DHA Announcements

Always rely on official DHA updates, not market rumors.

5. Invest During Market Dips

Quiet phases = best buying opportunities.

Final Thoughts

DHA Lahore Phase 10 offers a promising long-term opportunity for investors who value future appreciation and DHA’s credibility. While not suitable for short-term flipping, it remains a strong pick for those willing to stay patient and make informed decisions.

DHA Lahore Phase 10: Short-Term Gains or Long-Term Investment? (Updated November , 2025)

DHA Lahore has consistently been a trusted name in Pakistan’s real estate sector, and with the emergence of new phases, Phase 10 is now at the forefront of investment discussions. Investors are keen to know: is DHA Lahore Phase 10 a short-term flip opportunity, or does it represent a long-term goldmine? This article delves into the current market overview, development updates, investment strategies, and expert insights to help you make an informed decision.

Current Market Overview

As of late 2025, the market for DHA Lahore Phase 10 has stabilized after several months of fluctuations. Many analysts note that file prices are now significantly lower than their previous peaks, creating a potentially lucrative entry point for new investors. This stabilization has encouraged both seasoned and new investors to consider Phase 10 as a viable option.

Development Updates and Balloting News

Exciting developments are on the horizon for DHA Phase 10. Sources indicate that important balloting and development announcements are expected within the next six months. Blocks A, B, and C have been prioritized for early development, with possession likely to be granted within 3 to 5 years. The phase encompasses over 100,000 kanals of land, with about 46,000 kanals already cleared, ensuring smooth progression once construction begins.

This anticipated progress positions Phase 10 as both a short-term speculation opportunity and a long-term capital growth project. Investors can look forward to significant developments that enhance the value of their investments.

Affidavit vs. Allocation: What’s the Best Choice?

When considering investments in DHA Lahore Phase 10, investors often debate between affidavit and allocation files. Here’s a quick comparison:

| Feature | Affidavit File | Allocation File |

|---|---|---|

| Transfer Tax | 1.5% | 4.5% |

| Buying Price | Slightly higher | Slightly lower |

| Transfer Authority | DHA | DHA |

| Liquidity | Moderate | High |

| Investor Type | Ideal for filers | Suitable for traders |

Expert Tip: If you’re a registered filer, allocation may be more beneficial as FBR taxes are adjustable. However, affidavit files often yield better resale margins after tax considerations.

Short-Term vs. Long-Term Investment Strategies

Short-Term Flip (6-12 Months)

For investors looking for quick returns, Phase 10 presents an ideal scenario if DHA announces balloting or development soon. Prices may surge by 10-20% upon major news, making it a perfect opportunity for active investors who keep a close eye on market trends.

Long-Term Goldmine (3-5 Years)

For those considering a more extended investment horizon, Phase 10’s strategic location near key roads like Ring Road, Ferozepur Road, and Bedian Road promises excellent future accessibility. As development progresses, both residential and commercial files are likely to appreciate steadily, making this an ideal choice for investors seeking capital appreciation and secure, tax-compliant assets.

Market Sentiment and Expert Views

Experts, including analysts from Lahore Real Estate, affirm that “Phase 10 is both safe and secure — easy to buy and sell.” While small price fluctuations may occur, particularly in 2 Kanal and commercial files, major declines are unlikely due to limited seller supply. The market is described as stable yet promising, with controlled supply and significant long-term upside.

Tax Insights (2025 Update)

Understanding the tax implications is crucial for any investor. Here are the key tax insights for DHA Lahore Phase 10:

- Affidavit File Selling Tax: 1.5%

- Allocation File Selling Tax: 4.5%

- Capital Gains Tax (CGT): Applies if held for less than 3 years (subject to FBR updates).

- Buyers’ Withholding Tax: Recently reduced for filers under FBR regulations.

These tax details make DHA Phase 10 particularly attractive for registered filers aiming to minimize transaction costs.

Final Verdict: Should You Buy in Phase 10?

The answer is a resounding yes if you’re looking for a safe, flexible investment with both short-term and long-term potential. DHA Phase 10 is currently at a “bottomed-out” stage, characterized by low prices and limited seller supply. With new announcements expected from DHA, now is an opportune moment to invest.

Whether you plan to flip in 2025 or hold for 3-5 years, the entry point is strong, and the downside risk is minimal compared to other phases.

Join The Discussion

You must be logged in to post a comment.